-

What happens when billionaires own the zip code, and everything within it? Part two in our series on the future of living in America.

During the Industrial Revolution, company towns sprang up across the United States like dandelions after a downpour. Built by steel tycoons, coal barons, and chocolate magnates, these places were designed to allow workers to live close to where they work — keeping them away from the denigrating poverty of inner cities, and keeping them under close watch.

Some versions were brutal: Kentucky coal towns like Lynch, for example, were notorious for housing miners in shacks with no plumbing and paying them in company scrip that could only be spent on overpriced goods at the company store. Others tried to pass as idyllic: Hershey, Pennsylvania had neat lawns, bowling alleys, and a chocolate-fueled amusement park. Corning, New York had museums and libraries courtesy of the glass company. Pullman, Illinois had stylish worker housing until the company slashed wages but kept rents high, sparking a nationwide strike.

What they all had in common was control. Workers lived where their bosses told them, bought what their bosses sold them, and behaved how their bosses expected. The message was clear: if you want a paycheck, you play by the rules. Sometimes, that meant waking up to factory bells at 4:30 in the morning and attending mandatory church service. Sometimes, it meant not striking, not speaking up, and definitely not trying to unionize.

The company town model was supposed to fade away with the rise of public infrastructure and labor rights. But it didn’t — it just got rebranded.

Today’s version comes with better marketing. The factory bells have been replaced with free yoga, wellness apps and solar panels. “Moral behavior” now means staying within the parameters of a 15-minute city or a biometric security fence. The new company towns don’t just expect conformity — they engineer it.

In this article we look at the modern resurrection of the company town:

- Starbase, Elon Musk’s handpicked city, governed by his employees and gated from the public.

- Lāna‘i, a Hawaiian island once run by Dole Pineapple, now owned by one man.

- Belmont, Bill Gates’ planned desert city built around data centers.

- And Sidewalk Labs, Google’s failed attempt to privatize (and surveil) a piece of the Toronto waterfront.

In all these cases, the model is the same: a private entity builds the world it wants, sets the rules, and invites you to live in it — on its terms, not yours. While the new company town may be smarter, greener, and more connected — it’s just as rapacious and controlling as ever.

Starbase, Texas is Elon Musk’s 21st-century company town built on a sandy strip on the Gulf of Mexico formerly known as Boca Chica Village. It began, like so many Musk projects, with a tweet. In 2021, he announced plans to build a city around SpaceX’s rocket launch site and soon began buying up houses in the once-quiet coastal village, turning it into a restricted zone for private launches, tourists, and security patrols.

Some locals resisted, calling it rocket fueled gentrification, but Musk pressed on and in early May 2025, Starbase officially became a city after what may have been one of the strangest elections in modern American history. No campaign signs, no public debates — just 280 eligible voters, most of them SpaceX employees or their relatives. Roughly 90% of them registered to vote within the past year, and most of them were young men. When ballots were cast, the city’s incorporation measure passed 212 to 6. The new mayor is a SpaceX vice president and all the commissioners are also tied to SpaceX. In Starbase, corporate loyalty is literally a civic requirement.

The company has wasted no time consolidating control. Just weeks after incorporation, Starbase moved to adopt sweeping zoning ordinances. Residents received legal letters that noted, in all-caps letters no less, “YOU MAY LOSE THE RIGHT TO CONTINUE USING YOUR PROPERTY FOR ITS CURRENT USE.” Many properties — some held for decades by families who came to fish, hunt, or retire in peace — are now designated as “Mixed Use,” “Heavy Industrial,” or “Open Space.”

The letter informed recipients of a public hearing, which took place this past Monday, June 23, 2025. About 80 people showed up to voice their confusion and anger and ask why they were being strong-armed into new zoning rules they didn’t understand. Some asked how their property rights would be affected, or whether SpaceX might use eminent domain. The city attorney denied it — “not what this is,” he said — but to landowners who feel outnumbered and outmaneuvered, the writing’s on the wall. If SpaceX doesn’t own your land yet, it wants to control what you can do with it. One local said he felt “like a Native American, because these people are coming in… making their rules, and it’s a done deal, basically.” Another expressed amazement at the new map the city is proposing. “Have you seen it?” he said. “It looks like a spider web on LSD.”

And then there are the gates.

Citing “security concerns,” and “folks who aren’t necessarily here for the right reasons,” the city commission — staffed by SpaceX employees — approved the installation of four gated checkpoints, turning formerly public roads into controlled-access zones. Some gates were completed before the vote even took place, raising questions about whether the company was simply rubber-stamping its own decisions after the fact.

“That is a travesty,” said Mike Montes Jr., who attended the June 23 meeting. “I think they are trying to have a private interplanetarian community.”

Officials say residents will still be allowed in and first responders will get access codes. Visitors can be “screened.” But critics — including property owners and even the local district attorney — say blocking public roads violates Texas law.

Meanwhile, Starbase is operating on borrowed money — literally. The city took out a $1.5 million zero-interest loan from SpaceX to fund its startup budget through September 2025. No sales tax. No property tax yet. Just corporate credit from the only business in town.

If this all sounds a bit dystopian to you, you’re not wrong. Starbase is not the techno-utopia it pretends to be. It’s a municipal Halloween costume for a rocket company that wants legal cover to control land, people, and infrastructure without state interference. It’s also a legal loophole: by incorporating as a city, Starbase gains more power to shut down roads, access public funding, and operate with municipal authority — all without any meaningful democratic input.

This is not Musk’s first foray into privatized governance. He’s floated plans for Mars colonies governed by “direct democracy” — a term that sounds egalitarian until you realize his company will also own the oxygen supply. Starbase is, therefore, the test site for more than rockets. It’s a dry run for post-national corporate rule.

Then there’s Lāna‘i, Hawaii. If Starbase is a company town for the 21st-century, Lānaʻi is its mirror image: a place steeped in company-town tradition, now rebooted by one of Silicon Valley’s richest men. Once dominated by pineapples, Lānaʻi is a living case study in how private ownership of public life mutates with the times — and why it still matters.

Purchased in 1922 by pineapple magnate James Dole, Lānaʻi quickly transformed into the world’s largest pineapple plantation and a textbook example of a model company town. Dole built not just the fields and packing houses, but also Lānaʻi City — the central town with a movie theater, a park, and homes for thousands of workers and their families. But this was no tropical utopia. As with many plantation towns, workers toiled long hours, earned little, and lived in housing owned by the same company that employed them. Dole controlled the economy, infrastructure, and much of daily life — and when the pineapple business dried up, so too did the island’s economic base.

That is, until another tycoon came along.

In 2009, the island was included on the National Trust for Historic Preservation’s list of America’s most endangered historic places. Three years later, in 2012, Oracle cofounder Larry Ellison bought 98% of the island for $300 million. The purchase included two Four Seasons resorts, the water utility, much of the housing, the community pool, and even the island’s movie theater. And in 2019, Ellison added one more asset to his collection: Lanai Today, the island’s only newspaper.

That’s right — the billionaire landlord is now also the publisher of the local press.

Ellison has remade Lānaʻi in his image: a wellness-focused, ultra-elite retreat where tourists arrive on private jets, dine at Nobu, and soak in curated luxury. At the same time, residents live in what critics call a “plantation 2.0” system. They work at Ellison’s hotels, rent homes from his holding company, shop at his grocery store, and read his newspaper. And while many residents express gratitude for Ellison’s pandemic generosity — he waived rent and kept people on payroll — others say the cost is quiet compliance.

Maui County Councilman Gabe Johnson put it bluntly: “This is still a plantation town, it’s a one-company town. To speak out in public, there’s risks involved for anyone.”

Residents who speak up about housing shortages, shrinking public services, or the mysterious drone testing project have to weigh those complaints against their livelihood. For many, Ellison is their landlord, employer, infrastructure provider, and de facto government. Dissent becomes a gamble.

Ellison claims he wants to turn Lānaʻi into a model of sustainability — powered by hydroponic farms, Tesla solar panels, and “an adults-only, luxurious wellness enclave.” But critics note that sustainability in this context often means control: of food, housing, jobs, and now, information.

[As an interesting aside, that previously mentioned drone project involves assembling and shipping giant unmanned drones called Hawk30, which have a wingspan of 260 feet and a cruise speed of nearly 70 miles per hour. Propelled by 10 electric motors and onboard lithium ion batteries, the drones are designed to carry 5G transmitting equipment for up to 6 months at about 65,000 feet in the stratosphere.]

Meanwhile, housing on Lānaʻi is tight and what little is available comes with sky-high rents. As of mid-2025, only about two dozen homes are available for sale — ranging from $315,000 for a 400 square foot condo to $17 million for an 8,500 square foot, 7-bedroom mansion.

Ellison’s defenders say he saved Lānaʻi from decline. He fixed the pool. He restored the movie theater. He preserved the resorts. But these efforts, while real, come with a catch: centralized ownership of nearly every lever of island life. In a place with just 3,000 residents, there’s no anonymity — and no public space truly free from the touch of Ellison’s empire.

From Dole to Ellison, Lānaʻi remains a study in soft coercion — where power is quiet, but absolute. If modern technocracy demands centralized data, urban control, and seamless citizen management, Lānaʻi may be its testbed. But unlike NEOM’s mirrored city or Telosa’s blueprint fantasy, this one already exists.

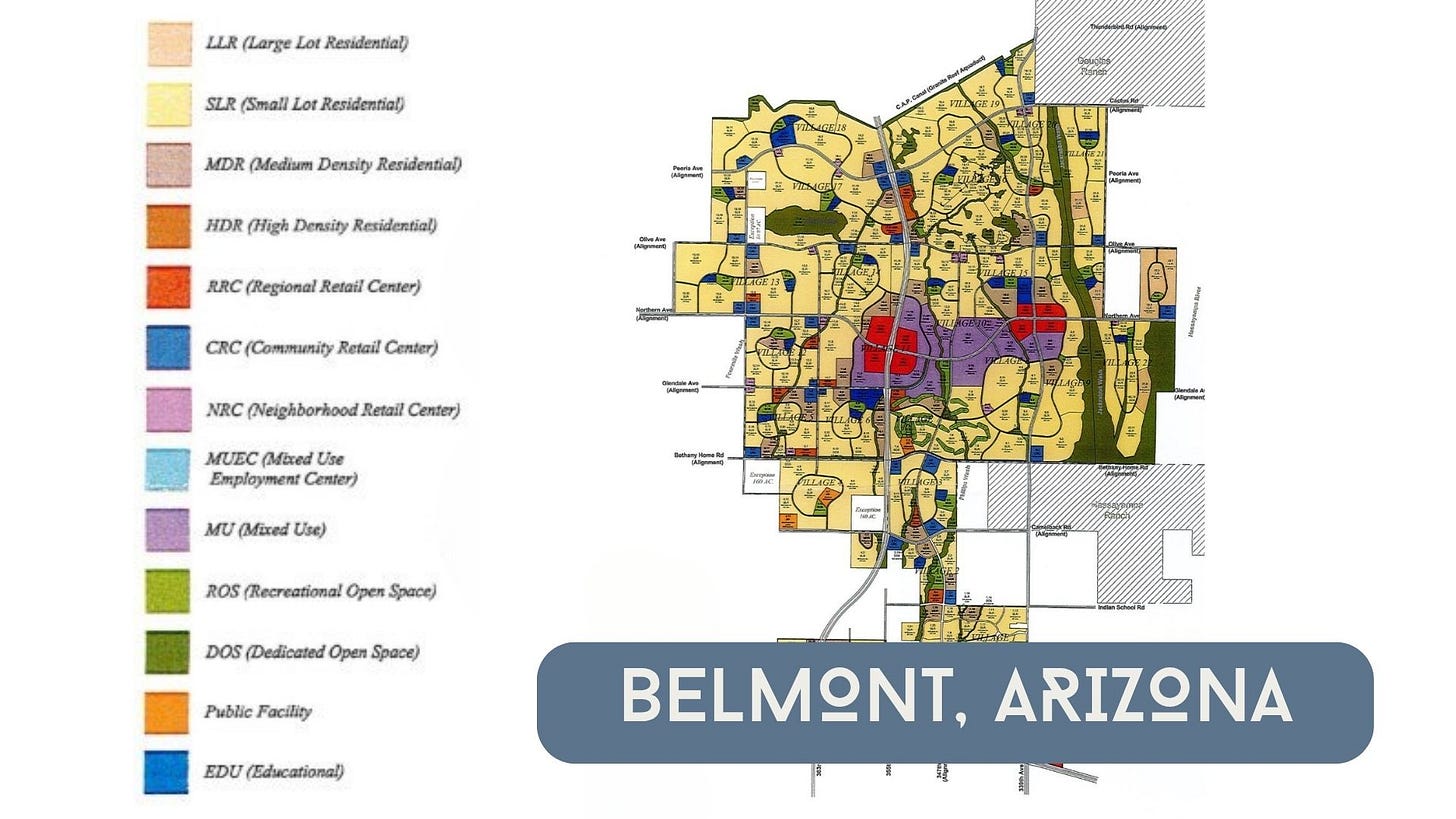

Belmont, Arizona, Bill Gates’ desert experiment, hasn’t even broken ground yet. Back in 2017, Gates quietly bought 24,800 acres of land west of Phoenix through his investment firm, Cascade, for $80 million. The plan is, by now, pretty obvious: Build a smart city with autonomous vehicles, sensor-stuffed homes, and traffic systems that think faster than you do. If it ever happens, the city will support 80,000 homes, 3,800 acres of industrial and office space, 470 acres for public schools, and enough infrastructure for around 180,000 people.

Nearly a decade later, Belmont remains an empty stretch of sand baking under the Arizona sun with no construction, no water, and just the vaguest promise that if you build a city around the internet of things, the people will come.

Perhaps Gates is wary of making the same mistakes Sidewalk Labs made when it set out to build the future of cities on Toronto’s waterfront. It had the backing of Alphabet, the parent company of Google, and a willing partner in Waterfront Toronto, a government agency responsible for redeveloping the lakeshore. But three years later, the $900 million project collapsed under its own weight — before a single shovel hit the ground.

On paper, Sidewalk Toronto offered all the usual utopian trimmings: heated sidewalks, robo-taxis, underground waste collection, dynamic buildings that shifted with the hour. But that was just the surface. Underneath was a far more radical proposition: to remake not just infrastructure, but governance. Data collection would be ubiquitous. Public systems — transportation, waste, energy, even benches — would be managed by software and sensors, with Sidewalk Labs at the helm.

That’s where it lost the public.

From the start, Toronto residents asked hard questions. Who would own the data? Who would make the rules? What kind of city turns public life into a private dataset? Sidewalk’s answers came too late — and rang hollow. The public wasn’t just wary of surveillance, they were wary of a tech company writing the rules of city life behind closed doors.

Waterfront Toronto tried to negotiate better terms, but it didn’t have the legal or political authority to manage what was, essentially, a transfer of public power to a private actor. The project wasn’t just a land deal — it was a Trojan horse for privatized governance.

And Toronto, in the end, said no.

This matters, because other companies are trying again elsewhere. Meta wants to build Willow Village in Menlo Park. Google has designs on Downtown West in San Jose. Each promises to solve the urban problems governments have failed to fix — housing, transit, climate — with data and design.

But if they don’t learn from Sidewalk Labs, they’re doomed to repeat its failure.

-

The Secret Exploitation Behind AI Training

As generative AI booms, an invisible workforce powers its rise – and pays the price. Platforms like Outlier.ai, DataAnnotation.tech, Remotasks (Scale AI), and industry veteran Appen promise freelance “AI trainers” flexible, high-paying work to help build advanced models. “

Earn up to $40 an hour… teaching AI models how to write,” one Outlier recruitment message said.

But behind the ads and testimonials lies a very different reality. Workers on these platforms describe algorithmic scoring systems that misjudge their work, mysterious account bans with no explanation, weeks of unpaid training, impossible task deadlines and being treated as disposable cogs in an AI assembly line. Support and accountability are non-existent – many freelancers have to turn to Reddit forums, LinkedIn posts or even lawsuits to get answers.

This investigative report goes beyond Outlier to show how the whole ecosystem of AI data annotation sites operates on the same tactics. DataAnnotation.tech, a platform run by Surge AI (serving clients like Anthropic and Microsoft) , and others like Remotasks (Scale AI’s gig-work arm for OpenAI, Meta, etc.inc.com) and Appen (a long-time data crowdsourcing firm) all do the same.

We’ll hear directly from contributors – via Reddit threads, Medium stories, LinkedIn posts, BBB complaints, Glassdoor/Indeed reviews – to see the human cost of training our machines.

AI trainers perform a range of tasks to fine-tune large language models — from writing prompts and correcting outputs to ranking AI-generated answers. This pie chart illustrates the estimated breakdown of typical responsibilities across major platforms. The AI Boom’s Invisible Workforce

Building an AI chatbot or image generator isn’t just about clever algorithms – it requires millions of human-labeled examples and constant human feedback. This work, known as data annotation, involves a range of tasks: writing or correcting model answers, labeling images or text, crafting prompts and responses, ranking outputs by quality, and flagging errors or toxic content.

“Workers complete tasks such as writing and coding, which tech companies then use to develop AI systems,” explains TIME, noting many AI models rely on supervised learning with labeled datatime.com.

Even cutting-edge “unsupervised” models often need a final human fine-tuning step. In other words, without legions of human annotators, large language models and generative AI would not achieve their impressive feats.

This work is usually outsourced to online platforms. Some, like Amazon Mechanical Turk or Upwork, operate openly. But many AI firms prefer stealth. Scale AI, for example, channels gig workers into Remotasks, a separate, worker-facing sitetime.com. Likewise, Surge AI reportedly runs Taskup.ai, DataAnnotation.tech, and Gethybrid.io as its crowd platformstime.com.

“Companies say secrecy is to protect sensitive R&D,” notes researcher Milagros Miceli, “but they also prefer secrecy because it reduces the chances they will be linked to potentially exploitative conditions.”

In practice, this means tech giants like OpenAI, Meta, Google, Anthropic, and Microsoft have an opaque supply chain of human labor labeling data behind their AI – often in far-flung countries with cheap labor and scant oversight.

The people doing this work are typically hired as independent contractors, paid by task or hour with no benefits or job security. Many are educated professionals or domain experts drawn by the promise of remote, flexible work in their field of knowledge.

“Outlier is a platform where experts in various fields…help build the world’s most advanced AI,” its site proclaims. Indeed, platforms seek out linguists, coders, writers, physicians, you name it – anyone who can help train AI in specialized areas.

In theory, it’s a new kind of high-skilled gig work. In reality, contributors often find themselves performing repetitive, rigidly controlled micro-tasks under intense surveillance. As we’ll see, the same technology they help improve is used to monitor and judge their every move.

This chart compares estimated onboarding hours versus actual compensated hours during the first month across Outlier.ai, DataAnnotation.tech, Remotasks, and Appen. Algorithmic Scoring: When AI Judges the Experts

One of the most common grievances across these platforms is the use of AI-driven or algorithmic scoring systems to evaluate contributor performance. Instead of consistent human oversight or feedback, workers are at the mercy of automated metrics that often misjudge quality and ignore human expertise.

On Outlier, for example, every task you submit is graded, and your “quality score” determines whether you can continue working.

“Instructions were extremely precise – a single misstep in formatting or failing to label an answer properly could lower my quality score,” wrote Shubhojeet Dey about his stint with Outlier.

If the score dips too low, *“I would be kicked off the project”*medium.com. Under such strict conditions, even highly knowledgeable contributors can be ousted over trivial issues.

A PhD-level contributor might craft a correct solution but get a low score for using an unexpected format or exceeding some arbitrary length. The system leaves no room for nuance or expert judgment – if you don’t match the hidden algorithmic criteria, you’re out.These scoring algorithms also create perverse incentives. Outlier tasks, for instance, impose tight time limits and then penalize workers for working “too slow.”

“Some tasks pay a ‘primary rate’ for a standard time limit. If you exceed that time, you earn a lower ‘secondary rate,’” Dey discoveredmedium.com. In practice, this means a project advertised at $35/hour might drop to effectively $20/hour if you take your time to ensure quality.

Rushing might keep your pay higher, but risks mistakes that tank your quality score – a Catch-22. Multiple reviewers have noted how Outlier’s pay system is tied to speed: “They want you to put in full-time hours… although they state ‘work when you want’,” one Glassdoor review observed, adding that “training is unpaid and often opaque.”

(In one case, a worker was even accused of using AI tools to do her task simply because she took an hour to carefully correct the model’s output, resulting in an automated 1/5 review and flag for supposed cheating.)

On Remotasks and Appen, algorithmic scoring is equally unforgiving. Appen’s search engine rating projects famously require raters to maintain an accuracy score (based on hidden gold-standard judgments); if your score falls below ~85%, you’re simply removed from the project – often without human appeal.

“Fired… no reason that I was told,” said one Appen web search rater, who called the company “a total scam and ripoff of your valuable time.”.

He had passed a difficult exam and worked diligently, only to be auto-terminated by the algorithm.

On Remotasks, too, low “accuracy” or client rating can trigger a suspension. Yet workers often receive little feedback on what they did “wrong,” making these systems feel arbitrary and unjust.

As one expert told TIME, these sites lean on “algorithmic management to keep their costs low,” which *“can result in the poor treatment that many workers experience.”

Errors or not, the platform can always find another contractor waiting in the wings.

Perhaps most emblematic is an Outlier project that tasked experts with “red-teaming” an AI – essentially trying to make the AI fail – under an impossible time crunch. Contributors were told to come up with prompts that expose the model’s weaknesses (e.g. producing harmful or nonsensical output) within just one hour.

According to multiple worker accounts, only a tiny fraction of participants managed to succeed; the rest “failed” the task and saw their quality ratings plummet. Ironically, those who did have deep expertise and a careful approach often refused to cut corners or submit half-baked prompts just to meet the timer – and were weeded out for it.

One Reddit contributor dryly observed that Outlier’s combination of tight time limits, constant retraining requirements, and pay rate cuts was “really becoming impractical”.

“Outlier is not the only AI training platform I am on, so I am well aware that a lot of these issues are just par for the course,” they added – a telling statement on industry-wide practices.

This chart contrasts advertised hourly pay with real-world effective rates after accounting for unpaid onboarding, task delays, and algorithmic deductions. Silent Removals and Shadowbans

This horizontal chart estimates relative complaint volume for shadowbans and silent terminations by platform. In a traditional job, if you underperform or violate a rule, you get warnings, perhaps a chance to correct course, or at least an explanation if you’re fired. On these AI gig platforms, workers often simply vanish from the system with zero explanation – a practice akin to shadowbanning or silent removal.

One day you’re working on tasks; the next day you’re locked out of your account or no new work appears, with no message from the company. Consider the experience of an educator on DataAnnotation.tech (a Surge AI site).

After diligently working on the platform and even being told they passed the initial assessment, they suddenly stopped receiving any tasks at all. Eventually they discovered their account had been deactivated – with $2,869 worth of completed work left unpaid.

“I emailed the companies’ support contacts, but did not hear back,” the worker reported in frustration. There was no explanation, no appeal; the door was just quietly shut.

Another contributor on a Surge-run platform recounted a similar story on Reddit: *“IME [In my experience] paid out $800 then my account disappeared with $2869 work sitting unapproved. Absolutely zero contact/reply from their support…”. Nearly $3k of his labor evaporated without a trace or response.

Outlier workers have faced the same. Multiple reviews on Glassdoor and Indeed describe accounts getting *“suspended”*or “disabled” out of the blue. One Indeed review titled “account banned for no reason” from April 2025 tells of a contributor who had “given my full patience to this platform” only to be accused by the system of “using third party software or automation tools”, resulting in instant account disablementindeed.com. “The fact is I never do that… I only use a laptop and a phone (for the camera),” the person lamentsindeed.com.

Similar stories abound on Reddit: “Out of the blue a week ago my account was suspended for violating their TOS with zero explanation. I’m always EXTREMELY careful not to do anything wrong,” wrote one Remotasks user.

Others were flagged for having “multiple accounts” or “misrepresentation” with no evidence provided.

This opaque ban hammer doesn’t just cut off future work – it often steals earned wages. A common allegation is that platforms intentionally suspend workers right before a payout is due.

“Scam company that will suspend your account so they don’t have to pay you for hours accrued,” one Glassdoor reviewer warned, claiming Outlier would “string [you] along” and then drop you.

On the Better Business Bureau, a November 2024 complaint from an Outlier contributor details how their account was suspended for alleged guideline violations (which they denied), and that Outlier refused to pay $525 owed for their services.

The user offered to provide proof of their innocence, “yet they want to take away my hustle,” they wrote, noting that even after “investigation,” Outlier support still wouldn’t release the funds. The BBB lists this case’s status as Unanswered, reflecting Outlier’s lack of response.

Even less dramatic scenarios feel like shadowbanning. Contributors often describe being “EQ’ed” (put in an endless Evaluation Queue) or simply not receiving new projects without explanation.

One day you have tasks; the next, the dashboard is blank. “Our system is unable to find a project for you… Please contact support,” read the message one Outlier freelancer saw after finishing a few tasks.

He reached out and *“now I am waiting to hear back… not holding my breath.”*glassdoor.co.nz In many cases, support never responds at all.

As one veteran worker observed, “there is no transparency about [gig] worker relations” – management simply does not communicateindeed.com.

This silent treatment extends to internal communication channels too. Outlier uses a private Discourse forum for project discussions; multiple workers reported being locked out of all forums and chats without notice after completing certain tasksbbb.orgbbb.org.

“Losing access to all communication channels and history… wiped clean without my consent,”one person described, saying projects and even direct messages vanished overnight.

It’s as if the companies want to erase any trace of the worker’s involvement the moment they decide to cut ties. The psychological toll of this sudden, silent ostracization is not trivial:

“This prolonged absence of communication has resulted in emotional distress that could easily be alleviated with a simple acknowledgment or update,” the BBB complainant wrote, “Instead, I am left without support or guidance.”

This chart highlights the estimated percentage of workers who report missing or delayed payments. Unpaid Onboarding and Unrealistic Tests

Before a contributor ever earns a dime, they typically must clear a gauntlet of onboarding steps, exams, and training modules – almost always unpaid. The length and complexity of these qualifications have ballooned as companies try to ensure “quality” (or filter out people unwilling to work for pennies).

The result is that many workers invest hours or even days of labor up front with no guarantee of any pay at all.

A BBB complaint against Outlier from late 2024 illustrates this “work-for-free” onboarding in detail. “Since joining Outlier, I have dedicated hundreds of unpaid hours to onboarding processes, training tutorials, assessment tasks, and project-specific modules,” the contributor wrote.

For every project, Outlier required a lengthy sequence: hours-long tutorials and webinars, extremely long guideline documents to read, lengthy training videos, followed by quizzes and exams on all that materialbbb.org. The complainant counted “over 80 onboarding processes, tutorials, and assessment tasks” they had completed for various projects – all unpaid.

In some cases, the “assessment tasks” were indistinguishable from real paid tasks, yet were compensated at only “a fraction of the offered hourly rate.” (In other words, the platform got essentially free labor by having newcomers do actual work as their “test.”)

Worst of all, this user experienced projects that “disappeared entirely” after they finished all required onboarding, meaning all that effort was for nothingbbb.org. It’s hard to imagine a more blatant example of dangling a carrot and then snatching it away.

Outlier is not alone. Remotasks’ training center requires users to pass a series of courses and exams before paid work opens up. “To access a paying task, I first had to complete an associated (unpaid) intro course,” a journalist who signed up for Remotasks reported.

Every specialization – say, labeling autonomous vehicle sensor data – had its own multi-hour tutorial and test. If the project ended or you failed the exam, tough luck.

“Annotators spend hours reading instructions and completing unpaid trainings only to do a dozen tasks and then have the project end,” The Verge found, describing Remotasks’ feast-or-famine workflow.

One Kenyan Remotasks worker said he avoided certain tasks entirely because the training was long and the pay too low to be worth it.

Appen too requires unpaid training. Many Appen contractors recall spending 20+ hours reading dense guidelines and taking a tough exam (sometimes split into 3 parts over several days) for roles like search engine evaluator – all unpaid. Those who fail simply get a form email weeks later, if that. “If a user isn’t accepted… they typically don’t hear anything after completion of the assessment,” TIME notes as a common scenariotime.com. Even those who pass may sit idle for weeks before any paying task appears. “I was accepted… then my recruiter disappeared,” reads one Glassdoor review titled in frustration.

The pattern is clear: these platforms demand free labor up-front, calling it “assessment” or “training.” Some workers tolerate it hoping it pays off. Others call it out as a scam. “They seek highly educated people under false pretenses for unpaid and nonexistent work,” one angry reviewer wrote, saying Outlier “lies and gaslights you”through the process. Another simply states: *“Training is unpaid and doesn’t cover what you actually need to do.”*glassdoor.com – after all that prep, you’re still thrown into tasks that differ from what was taught.

In some cases, workers do everything right in onboarding and still see little or no reward. “I have been working for [DataAnnotation] a couple of months now and made a couple thousand bucks. They test and train all kinds of AI,” one Reddit user posted, *“It’s definitely not a scam!”. But others on DataAnnotation report a long wait after passing the test with no projects.

“I was told I passed the assessment, but then never got any tasks,” is a common refrain.

The luck of the draw can determine if you start earning or just end up in limbo.Even when onboarding leads to paid work, initial pay rates don’t hold. Several Outlier contributors describe a bait-and-switch after training.

“Before completing the onboarding process, I was promised $25/hour… after a few training modules (long, redundant, unhelpful), it showed I would be making $15/hr,” wrote one workerglassdoor.co.nz.

They worked nearly 2 hours and earned only $17 total – far below minimum wage when you include the training time. Then the system promptly ran out of tasks and locked them out with a tech support messageglassdoor.co.nz. Others mention being offered higher pay for specialized tasks (e.g. $40/hr for psychology content), only to rarely or never get those tasks, effectively putting them on $10–15/hr general duties insteadmedium.commedium.com. It’s as if the platform sets an “up to $X/hour” headline rate to attract skilled applicants, then funnels most people into far lower effective pay once they’ve sunk time into onboarding.

To make matters worse, some tasks have unrealistic time or difficulty constraints clearly designed to winnow out the workforce. The aforementioned Outlier “make the AI fail in one hour” mission is one example. Another is the Remotasks “Traffic Direction” project reported by The Verge, which required workers to interpret aerial images for self-driving car training – a notoriously complex task – yet paid only around $1–2 per hour in Kenya.

“Everyone knew to stay away from that one: too tricky, bad pay, not worth it,” one annotator said.

These companies seem to have no qualms about setting up challenges that only a minuscule fraction of workers can succeed at under the constraints given. The rest either fail (providing free data in the attempt) or quit in frustration – filtering out those who won’t endure near-impossible demands.

The same AI training tasks pay vastly different wages depending on the contributor’s location. This chart shows average hourly earnings across five regions, exposing the stark global wage gap. Churn and Burn: Disposable Workers by Design

Behind all these practices is a mindset that treats contributors as disposable labor, fueling a constant churn of new sign-ups to replace those cast aside. Rather than cultivating a stable pool of experienced annotators, the platforms operate a high-turnover model more akin to a digital sweatshop assembly line.

The sheer scale of hiring is telling. Outlier, a startup barely known a year ago, had “nearly 5,000 available jobs on Glassdoor” earlier this year as it recruited en masseinc.com.

“They hire thousands to work on limited projects,” one Glassdoor review revealed bluntly.

Many of those projects end or dry up quickly, at which point those thousands of workers may be left with nothing – or find themselves axed over minor infractions as discussed. “The work is uneven… Training and feedback are a joke,” that same review added, highlighting chaotic management.

This churn is highly profitable for the platform owners. Scale AI (Remotasks/Outlier’s parent) and Surge AI (DataAnnotation’s parent) can brag about having huge on-demand workforces to win contracts from AI clients, yet keep individuals at arm’s length.

If a project needs 1,000 annotators for two weeks, they spin up 1,000 new “freelancers.” When it’s done, most will get no further work or will be trimmed down to a small core for maintenance – the rest effectively laid off (without ever being considered employees to begin with).

In fact, Scale AI and Outlier were hit with a class-action lawsuit alleging they illegally misclassified workers and laid off 500 people without notice or severance in August 2023 when projects slowed. Gig workers have no protections under labor law’s WARN Act, but plaintiffs argue they functioned as full-time employees in all but name. The geographic distribution of labor also encourages a “race to the bottom.”

These platforms recruit globally, finding ever-cheaper pools of labor. A LinkedIn post by Analytics India Magazine blew the whistle on how Outlier (Scale AI) was paying Indian engineers as little as $7.50 per hour while advertising $40/hr for U.S. workers doing the same job. Payment delays to non-US workers were common, it said, and called it *“the dark side of AI development.”

Scale AI’s billions in venture funding and lucrative contracts stand in jarring contrast to its gig workers in India, Kenya, the Philippines or Venezuela making a few dollars an hour labeling data.

The Register noted that by late 2022, Kenyan Remotasks workers saw their pay drop to just $1–3 per hour, even as U.S. annotators on similar tasks made $15–25. When workers in higher-paying regions push back or leave, the platform simply shifts more work to lower-cost regions. This constant churn and wage arbitrage keeps costs low – and workers perpetually insecure.

Performance surveillance further underscores the disposability. Every click, keystroke, and submission is tracked. The moment productivity dips or errors rise, the system flags you. Workers describe feeling like they’re always one mistake away from being removed, with no human manager to hear them out.

“People will literally put up with it because they know jobs are scarce,” one Reddit commenter noted.

“The crappy thing is [the platforms] know people don’t have a lot of job options right now and that’s why they likely do it.”

Fear and desperation become management tools in lieu of fair pay or support. Why invest in any single worker when another hundred are signing up tomorrow? As long as the AI companies keep needing more labeled data, the platforms will keep cycling through human labelers in an endless on-boarding, churn-out process. In the words of one disillusioned Glassdoor reviewer,

“I can’t find any hope for their future due to this poor… management.”

No Accountability:

Workers Left to Crowdsource Their SurvivalIf there is one theme that ties all these threads together, it is the complete lack of accountability and communication from the platforms to the workforce. Contributors find themselves in a feedback void: when things go wrong, the company is a brick wall. Outlier’s BBB profile shows multiple complaints marked “Unanswered” – the business simply never responded to the disputesbbb.org.

“Management, if it exists, does not communicate,”wrote an Indeed reviewer of DataAnnotation (or perhaps Appen), *“there is no transparency about… relations.”*

In practical terms, support tickets disappear into a black hole.

One BBB complainant waited five days, then two weeks with no response to urgent support inquiries about her locked account. “My inquiries seem to be ignored for unknown reasons,” she wrote, noting this was *“contrary to standard business practices.”*bbb.org That’s putting it mildly – in any normal job, being unable to log in and not getting help for weeks would be unthinkable.

Because official channels are unresponsive or unhelpful, workers are forced to crowdsource help and information.

The Outlier AI subreddit (r/outlier_ai) has over 3,600 members who regularly share tips, complain about issues and alert each other to red flagsinc.cominc.com.

“Difficulty in getting paid, arduous onboarding processes…and uncertainty regarding Outlier’s legitimacy,” are common topics, Inc. magazine observed of the subreddit discussionsinc.cominc.com.

On these forums and on platforms like Reddit’s r/WorkOnline or r/WFHJobs, you’ll find hundreds of threads about Remotasks suspensions, DataAnnotation account issues, Appen no-work dilemmas, and more.

Often, the only “support reps” who answer are fellow workers who may have figured out a workaround or just offer commiseration. In some cases, exasperated workers turn to Twitter/X or LinkedIn posts to publicly shame the company, hoping to get a response.

(Outlier’s own Twitter account is empty, but replies to its tweets show users asking why they were banned or unpaid – with no reply). Even the Better Business Bureau and media inquiries sometimes get no response – Surge AI declined to comment to TIME.com, and Outlier/Scale AI gave only generic statements when asked.

This lack of communication extends to the work itself. Because of NDAs and secrecy, contributors often don’t even know which company’s AI product they are building – they are given code names and siloed tasks.

And they’re told not to tell anyone about their work. This isolates workers and makes collective action or even sharing “best practices” difficult (which, of course, benefits the platforms).

Where do we want AI to be in our lives? In the absence of official information, rumor fills the void. Workers speculate on why a project ended or why a ban happened, trading anecdotes on Discord or WhatsApp groups. (Remotasks workers in Nairobi coordinate via unofficial WhatsApp groups to alert each other when a good-paying task becomes available.)

It’s an almost Kafkaesque environment where the true intentions and operations of the employer are obscured, leaving workers to guess at how to stay in good standing.

All of this serves to minimize the platforms’ accountability. If no one can pin down why they were fired or who made the call, it’s hard to hold the company responsible. If workers are scattered globally and can only share stories on Reddit, it’s hard to organize or demand better conditions.

And the platforms’ clients – the big tech companies – maintain plausible deniability about the labor issues, since they contract the work out to these middleman services.

As Privacy International noted, the vast scale of labeled data needed for AI has led companies to spread the work across many countries and contractors, “with cheaper and more [workers]” in each, making abuses harder to track. The result is a diffuse, atomized workforce with no leverage, at the mercy of each platform’s internal algorithms and policies.

From the perspective of Silicon Valley, this system has been a huge success: AI models get better and better, costs stay low and labor issues are out of sight, behind layers of outsourcing. But for the people on the other side of the screen, these AI training platforms are a new kind of digital sweatshop – one that harnesses human intelligence while denying human dignity.

The stories of Outlier, DataAnnotation.tech, Remotasks, Appen and others show a pattern of luring skilled workers into the AI boom with promises of high pay and flexibility, only to subject them to old-fashioned exploitation: unpaid work, erratic pay, constant surveillance, sudden terminations and zero voice or recourse.

It’s bitterly ironic that the same companies touting “AI for good” and revolutionary tech are, behind closed doors, running a playbook of labor practices worthy of the 19th century. The very algorithms these workers help refine are being used to manage and discard them. And the “AI boom” that promises to augment human potential is being built on a foundation of treating human workers as machine-like inputs – easily switched on and off.

The hidden exploitation of AI’s gig platforms calls into question the true cost of our smart new world. As we marvel at chatbots that can write poetry or cars that can (almost) drive themselves, it’s worth remembering the real intelligence behind these feats: the thousands of human contributors, clicking for hours in anonymity, uncredited and underpaid.

Bringing this labor out of the shadows is the first step towards reform. Regulators and AI companies need to acknowledge that quality AI isn’t possible without quality treatment of the people training it. Some are calling for transparency reports and labor standards for data annotation, just as there are for supply chains in manufacturingtheregister.comtheregister.com. Others advocate collective organizing of gig annotators across platforms.

At a minimum, these workers deserve fair pay for all hours worked (including training), clear communication and due process, and mental health support for the disturbing content some must handle. The alternative is to continue down the path we’re on – where the human cost of AI remains hidden in a cloud of NDAs and algorithms, and the people best equipped to improve AI are driven away by poor conditions. The next time you see an AI in action, think of the people in the shadows.

-

Politics in a Post-Apocalyptic World

Allow me a moment to preface what I want to say with a disclaimer. That is, I hate politics. Oh, I know I’ve written about politics in the past, talking about the actions of one politician or another and how that might affect you and I; but I certainly didn’t do that out of any love for politics or the political process. I’ve spent all my life voting against candidates, more than voting for them, because I really haven’t seen all that many candidates who truly embodied my beliefs. So, I find myself voting against the one who is furthest from where I stand, by voting for the other one. What a crazy way to run a railroad.

Watching this news can change your life…

This is not to say that I am against democracy, even though we’re not one (we’re a constitutional republic, which is not the same thing). Nor am I against our country. We’re still the greatest country on the face of the earth, despite our flaws. We didn’t become greatest by eliminating our flaws, but because our flaws pale in comparison to other countries, both past and present. We’re far from perfect, but at least we’re working on it.

Nonetheless, even though I hate politics, I see the need for it. One has to look no further than the many examples of countries where governments have fallen, to see the need for politics. Even with all it gets wrong, it is the political process that allows us to live together under a set of laws that have been created with the intent of treating all people equally.

As I look at the political landscape today, I can’t help but think that if there’s anything that will tear this country apart, it’s politics. We find ourselves living in a time where the political divide (which has always existed) is deeper and wider than ever before. Most people, on both sides, live in an echo chamber, only listening to voices which parrot their own political thoughts. The idea that I grew up with, that both sides sit down at the table and find a middle ground which works for everyone, is long gone.

We are probably headed towards another civil war and it will be just as ugly as the last one was. That one was over political issues as well (slavery was a political issue in those days). The big difference is that the lines between the two sides won’t be as clean cut as they were before. That will likely lead to many non-combatants falling victim to the battle. But the biggest casualty will be our nation itself.

What happens when that system collapses?

There have been a fair number of examples of political and economic collapse that we can find in history. Almost universally, the lack of a solid political system has led to anarchy, with warlords rising up to take control. Those warlords strive to gain territory, fighting between themselves for supremacy. Through that, it is the innocent people in the population who suffer.

It’s kind of funny that our news media even tries to make some of these warlords look good. They are no better off than a barbarian chieftain who invades and conquers. The occasional acts of mercy they might display are carefully crafted to make them look good, often with some personal benefit to the warlord at the same time. They are takers, even more so than our current crop of politicians.

There are many of us who look all but look forward with anticipation to a societal collapse. We want a release from the oppressive burden of our political overlords and want to put our survival knowledge to work, living as we’ve always dreamed; self-sufficient masters of our own fate.

Sadly, that’s a false image. While we would have to put our survival skills to use and be self-sufficient, we wouldn’t be living in an ideal world. That is, unless you happen to have the keys to the lost valley of Shanga La. Rather, we would find ourselves living in the midst of gang warfare, with constant battles all around. If any of the warring factions even suspected that we had a stockpile of supplies, they would attack us, over and over again, until they killed us. I know you probably think you can survive that; think again… there are more of them, than there are of us.

So, what’s the answer?

The more I’ve studied this out, the more I’ve realized that part of our survival strategy has to be the restoration of local government; the quicker, the better. I’m not sure yet what to do about higher levels of government and I’m not really all that sure that we can do anything; but if we want to live in any semblance of peace, we’re going to have to do something at the local level.

That means someone stepping up to take the place of leading the people, while talking about the need to reestablish the local government. If you and I don’t do that, someone will; and we might not be all that happy about who that someone is. They might be those very same warlords that I’m talking about avoiding and they might be socialist politicians, who are going to come after us, just because we have resources they need to redistribute, in order to make themselves look good. Either way, it won’t be good for us if they get into power.

According to NASA, we’re going to face a 100-YEAR LONG DROUGHT.

That leaves us with two viable options. The first is to take power ourselves and the second is to get behind someone we can trust, helping them to take power. The problem with supporting someone else, of course, is that we don’t really know how much we can trust them. Even our best friend could turn against us, wanting to redistribute our stockpile in order to garner political favor, as soon as they realize they don’t need us anymore.

Start in Your Neighborhood

The first place to start any rebuilding of the government is right there where you are. I’ve written before about working together with neighbors in a time of crisis. Being the one who brings order to your neighborhood and ensures your neighbors’ survival will naturally put you in a position of leadership within your neighborhood. As word gets out and more people join your neighborhood survival team, that leadership will naturally spread to include a broader area.

This won’t be hard to accomplish, as most people will be looking for some sort of leadership to rise up and tell them what to do. Your challenge in this case will be to make people realize that any help you offer comes with a price tag. That is, they’re going to have to work for the betterment of the survival group, doing their part to help make sure that everyone survives, even if that work is something that they consider to be beneath them.

Considering today’s entitlement society, this may be harder than it sounds. There will likely be plenty of people around, who are expecting the government to take care of them. These people may look at you as the government, even before there is any government in place, and thing that they are entitled to whatever help you can give them. the easy solution to that problem, is to just kick them out of the group. When they come back, and they likely will, they need to sign on the dotted line, indicating they understand that they need to work in order to receive anything.

Reestablish Law and Order

The main reason we need any government at all, is the establishment of law and order. While the federal government we have today may have gone far beyond this point, pretty much everything they do, especially all the overreaching regulations, can be described as a way of maintaining law and order. It’s just whether or not one accepts their right to have control over the things they are writing laws and regulations about.

On a much more basic level, laws aren’t about how much carbon dioxide a company can produce, but about whether or not one person can do harm to another. Theft, vandalism, rape and murder are all clear cases of one person doing something that brings harm to someone else. we need law enforcement to capture those who commit those acts and the court system to try and sentence them for committing those crimes.

At its core, our laws are based on the Old Testament Law established in the Bible, especially the Ten Commandments. Even the right to use deadly force in self-defense is established in the Old Testament Law. So, the Ten Commandments are a good starting place; making sure that people don’t do one another harm.

Before we had police or even much of a government here in the United States, we had local law enforcement in the form of vigilante groups. The same could easily be reestablished, using local civic organizations and church groups to create the vigilantes. While the skinny jeans crowd might not get it, most real men will quickly see the advantage of working together to ensure their families safe.

Vote in a Local Government

Creating a local work group to take care of neighborhood needs and reestablishing law and order lay the groundwork necessary to take on the next step; voting in a local government. In doing this, you’re actually just going back to the founding principles of our country and the documents that created it. That’s your legal precedence, should anyone argue what you’re trying to do.

Although we are not a democracy, but rather a republic, the election of our representative government is a democratic process; one which gives every citizen a voice. That’s important, as anything less gives people the idea that they have no say in what happens. Unfortunately, it makes voting a much harder process than we might think it would be. Before the actual vote can happen, voter rolls must be created, defining who has the right to vote and who doesn’t.

How that happens will be the biggest challenge in creating any sort of local government. Some will want to include everyone who is living in your town or city, regardless of citizenship. Others will want to take a more conservative route, limiting the vote to only citizens. But without any viable means of proving that citizenship, we might be forced to open the vote up to everyone, so as to prevent robbing a vote from someone who should have that right.

Regardless of how it happens, this should be out goal. As attractive as the idea of living alone, in a survival retreat might seem, the only way that we will have peace, is to ensure that we have government as well. That means inviting back all the old evils that government brings; but it is done in the hopes of avoiding even greater evils.

Source- survivopedia.com

-

The secured funding engine behind modern markets.

For all the attention that stock markets and interest rates get, the real heartbeat of the global financial system ticks quietly in the background: the repo market.

Short for repurchase agreements, repos are short-term secured loans that underpin daily funding flows across the global financial system. Banks, dealers, money market funds, hedge funds, and insurers all rely on repos to borrow or lend cash against high-quality collateral, typically government bonds. It’s the mechanism that keeps liquidity circulating. Without it, credit markets would seize, central banks would lose control over short-term rates, and liquidity mismatches would surface across everything from derivatives desks to corporate treasuries.

Most of the time, the repo market operates quietly in the background, invisible to most. But in moments of stress (like the “repocalypse” of September 2019 or the crunch of March 2020), it becomes the centre of gravity. When repo markets break, the rest of the system feels it fast.

This primer runs through:

– Repo market basics (mechanics and visualisation)

– Why collateral is everything

– Repo’s role in monetary policy and liquidity transmission

– Historical stress events and market fragility

– Key participants in the ecosystem

– Trading strategies, from balance sheet engineering to funding arbitrage(If you like FX basis, STIRs, or balance sheet plumbing, you’ll feel right at home. If you don’t, grab a coffee and read it twice. This is the machinery behind the curtain.)

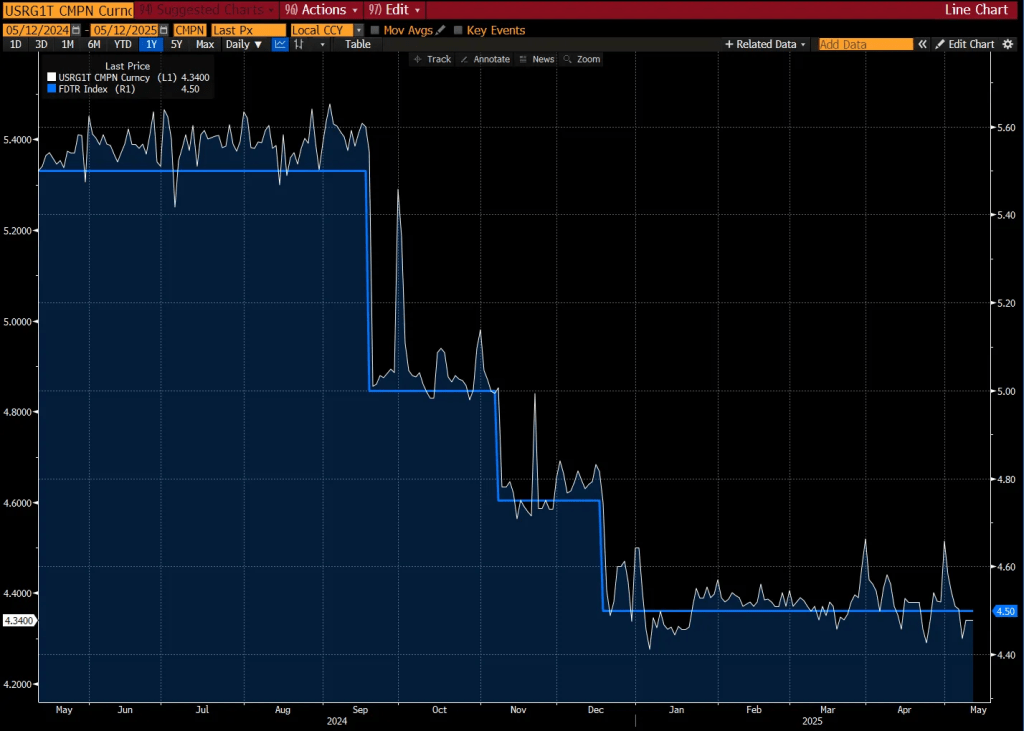

Note: When we refer to the “repo rate”, we’re generally referencing the overnight General Collateral (GC) rate on U.S. Treasury collateral. Bloomberg ticker: USRG1T.

Understanding Repo Markets

At its core, a repurchase agreement (or repo) is a short-term collateralised loan. One party sells securities (typically government bonds) to another, with an agreement to buy them back later at a slightly higher price.

There are two legs to every repo transaction:

– Initial Sale: The seller delivers securities and receives cash.

– Repurchase: The buyer returns the securities and is repaid with a small interest payment, known as the repo rate.From the cash lender’s perspective, the repo is a secured loan. From the borrower’s side, it’s short-term funding backed by liquid, high-quality collateral.

Repo transactions can be structured in various tenors. The most common are overnight, but term repos and open repos1 are also widely used. These agreements sit across a layered architecture—tri-party, interdealer, and bilateral—each with its own operational structures and risk conventions.

Basic Mechanics

Example: A dealer facing month-end balance sheet constraints enters an overnight repo. To manage its leverage ratio, the dealer pledges $1 billion of US Treasuries as collateral and borrows cash at the GC rate. The next morning, the dealer repurchases the securities at a slightly higher price, having secured short-term funding while temporarily reducing balance sheet usage.

Repo Seller (Borrower):

– Needs $X million in cash overnight.

– Sells $1 billion of Treasuries into the repo market.

– Agrees to repurchase the Treasuries the next day at a pre-agreed price (original notional + accrued interest).

– The implied interest, when annualised, reflects the repo rate.Example: A corporate treasury team managing excess liquidity allocates capital into overnight repos to preserve flexibility while earning a secured return. The company lends cash to the market and receives US Treasuries as collateral, which are returned the following day.

Repo Buyer (Lender/Reverse Repo):

– Has $1 billion in excess liquidity.

– Lends into the repo market and receives Treasuries as collateral.

– Sells the Treasuries back the next day and is repaid the original cash plus interest.

– The implied interest, annualised, gives the repo rate.In both cases, collateral is assumed to be US Treasuries. In practice, repo rates vary depending on the quality and scarcity of collateral, the tenor of the trade, and market liquidity conditions.

Repo Markets Visualised

Our good friend

Conks is well known for his infographics, with the below providing a great in-depth view of repo market participants and trade flow routes in the repo space:

Repo Rates Versus Other Types

Understanding how repo rates compare to other short-term interest rates is critical for interpreting funding dynamics. The secured nature of repos sets them apart from unsecured lending rates and gives rise to different benchmarks with varying market relevance.

Fed Funds

The federal funds rate is the benchmark for unsecured overnight lending between US depository institutions. It represents the rate at which banks with surplus reserves lend to banks facing shortfalls, typically on an overnight basis.

By contrast, repo transactions are secured by collateral, most often in the form of US Treasuries. This collateralisation significantly reduces counterparty risk, which is why repo rates tend to price below unsecured benchmarks in times of stability.

While the federal funds target range is set by the Federal Reserve, the effective fed funds rate (EFFR) floats within that corridor and reflects actual transactions. The secured GC repo rate (USRG1T) tracks differently, anchored by the value of collateral and broader liquidity conditions in the Treasury market.

In short, repo markets reflect the cost of secured overnight liquidity. Fed funds reflect unsecured interbank trust. The gap between the two becomes especially telling during stress events or regulatory year-end effects.

SOFR

The Secured Overnight Financing Rate (SOFR) is conceptually closer to the GC repo rate. Both are benchmarks for secured overnight borrowing using Treasury collateral. However, there are key differences.

SOFR is calculated and published by the New York Fed once daily, based on a volume-weighted median of overnight repo transactions across a broad segment of the market, including bilateral and tri-party trades. It is designed as a comprehensive, stable benchmark to replace LIBOR.

The GC repo rate (USRG1T), on the other hand, reflects live, tradeable quotes in the dealer market—updated throughout the day and directly observable on Bloomberg terminals. It represents where cash actually clears in the interdealer tri-party market at any given time.

While SOFR and GC repo typically trade in close alignment, divergences can appear during quarter-ends or episodes of funding strain, where GC repo may spike while SOFR remains more stable due to its averaging methodology.

Think of SOFR as a backwards-looking composite, while GC repo prints live at the point of execution. Both reflect secured funding, but one is a benchmark; the other is a market rate.

Bilateral vs Tri-party Repo

The structure of a repo transaction (whether bilateral or tri-party) shapes everything from margining conventions to the interest rate paid.

Bilateral repo involves a direct agreement between two counterparties. Terms are negotiated on a deal-by-deal basis, allowing for greater flexibility in collateral type, haircut, and maturity. However, this flexibility comes with increased operational and counterparty risk, as each trade must be separately managed and settled.

Tri-party repo, by contrast, introduces a third-party clearing agent (typically BNY) to manage collateral selection, valuation, margining, and settlement. This model dominates the general collateral (GC) space due to its efficiency, scale, and automation.

In normal conditions, tri-party repo typically clears at tighter spreads (lower funding costs) than bilateral repo. This is driven by operational streamlining, deeper liquidity, and the netting benefits of large dealer platforms.

However, when specific collateral is needed, such as a particular off-the-run Treasury, bilateral trades become dominant. These so-called “specials” carry a lower implied yield for the lender and a higher funding cost for the borrower, as participants compete to borrow the same issue.

Put simply, general collateral lives in tri-party. Special collateral lives in bilateral. And the cost of funding adjusts accordingly.

Collateral in Repo Markets

If there’s one concept that sits at the heart of repo pricing, it’s collateral.

In theory, repos are about funding. In practice, they’re about collateral—its quality, availability, and desirability. The type of collateral pledged in a repo not only determines the interest rate but also shapes how trades clear, how risk is managed, and where stress emerges.

Typical Collateral

The repo market runs on a collateral hierarchy.

At the top are government bonds: US Treasuries, German Bunds, and UK Gilts. These are the most liquid and lowest-risk assets available in global markets. If a borrower defaults, these securities can be sold with minimal friction, which is why they attract the tightest repo spreads and lowest haircuts. They’re the closest thing to money without being money.

Next are agency securities, issued by US government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac. These instruments carry either implicit or explicit government backing, making them broadly acceptable as repo collateral, but with slightly wider spreads and higher haircuts than Treasuries. Their liquidity profile is strong, but not bulletproof.

Further down the stack are investment-grade corporate bonds. These can be repo’d, but usage is less common and much more selective. The credit risk is idiosyncratic, and the market liquidity is thinner. As a result, haircuts are wider, spreads are higher, and each trade tends to be bespoke.

Collateral eligibility and pricing are always a function of risk appetite, regulation, and market conditions, but this broad hierarchy remains intact across jurisdictions.

The Scarcity Factor

Not all collateral is equal. But sometimes, even among equals, one bond becomes more valuable than the rest.

This is where the concept of a “special” comes in. In repo terms, a bond goes “on special” when demand to borrow it overwhelms supply. This drives its repo rate below the GC rate, sometimes dramatically so.

A negative repo rate means the lender is effectively paying to lend the bond. Why would they do that? Because the borrower needs it badly enough to make it worthwhile, typically to cover a short, meet delivery obligations, or hedge a derivative.

The most common driver of specials is short positioning. If a hedge fund is short the 10-year Treasury future, for example, it may need to borrow the corresponding on-the-run 10-year note to deliver into settlement. When many funds crowd into the same trade, the pressure on that specific bond builds, and the repo rate collapses.

Example: March 2021. The most recently issued 10-year US Treasury note went sharply negative in repo. Hedge funds, betting on higher yields and higher inflation, had built significant short positions. To maintain those positions, they needed to borrow bonds. But quarter-end balance sheet constraints limited supply. Dealers, unwilling to lend freely, withheld inventory, tightening the squeeze. At the extreme, repo lenders were paying borrowers just to get access to the bond.

This dynamic made it more expensive to run short positions and signalled tension in the plumbing, despite no broader credit stress. The specialness eased as market positioning normalised, but it underscored how critical collateral dynamics are to funding stability.

Collateral Terms

When a repo trade is booked, the lender doesn’t fund 100% of the collateral’s face value. Instead, they apply a haircut—a discount that protects against market moves and counterparty default.

The size of the haircut depends on collateral quality:

– US Treasuries (on-the-run): ~1.00-2.00%

– Agency MBS or GSE debt: ~1.00%–5.00%

– Investment-grade corporates: 3.00% and aboveHaircuts are a crucial safeguard. If the borrower defaults, the lender needs a buffer to sell the collateral without incurring a loss. In times of market stress, haircuts can be raised, sometimes abruptly, forcing deleveraging and amplifying funding pressure.

Haircuts are also where repo intersects with regulation. Under Basel III, secured funding with high-quality collateral and low haircuts is treated favourably for capital and liquidity metrics. This has led to increased reliance on repo as a preferred form of bank funding.

Why Repo Markets Matter

Because retail investors don’t interact with the repo market, its importance is often overlooked. But make no mistake, this is the engine room of modern finance. Repo markets matter for three fundamental reasons:

Core Source of Short-Term Funding

Banks, dealers, and hedge funds depend on repo to fund bond inventories, deploy leverage, and manage day-to-day liquidity. For dealers, especially, repo enables financing of government securities positions without having to unwind them, preserving market liquidity and facilitating client flows.

It also allows institutions to optimise balance sheet usage. Under Basel III and similar regulatory frameworks, secured funding is treated more favourably than unsecured borrowing. Repo markets, particularly those backed by high-quality collateral, offer balance sheet-efficient access to liquidity.

In normal conditions, repo is deep, liquid, and relatively low-risk. But its role becomes even more vital during periods of stress, when unsecured markets freeze, repo often remains the last functioning funding route.

Anchor for Monetary Policy

Repo markets are one of the primary levers through which central banks transmit monetary policy.

Take the Fed’s policy corridor as an example: by conducting repo operations (injecting liquidity) or reverse repo operations (withdrawing liquidity), the Fed nudges overnight market rates toward its target range.

– In a liquidity squeeze, repos provide reserves, lowering short-term rates.

– In a glut, reverse repos soak up excess cash, lifting rates back toward target.Repo operations also serve as signalling tools. Adjustments in size, frequency, eligible collateral, or counterparty access can all communicate policy direction. And because repo rates influence a wide swath of short-term funding costs—from bank liabilities to commercial paper—they indirectly shape borrowing costs across the economy.

In effect, the repo rate doesn’t just track monetary policy. It helps enforce it.

Leading Indicator of Financial Stress

The repo market reflects the real-time price of cash and collateral. When tensions build—whether due to liquidity mismatches, balance sheet constraints, or collateral hoarding—repo rates move first.

– A sudden spike in GC repo can signal systemic funding stress.

– A deeply negative special rate might indicate positioning imbalances or collateral scarcity.

– A persistent divergence from central bank target rates suggests a breakdown in transmission.Repo dislocations are often the canary in the coal mine. In 2008, the withdrawal of repo funding preceded institutional failures. In September 2019, the Fed was forced to re-enter the market as GC rates spiked above 8%. In March 2020, even Treasury repo markets buckled under the strain.

When the repo market breaks, it’s not just a footnote, but often the first crack in the dam.

Notable Stress Events

While the repo market typically operates quietly in the background, it has been a central point of stress in several major financial episodes. Below are three examples where dislocations in repo funding revealed broader fragilities across markets.

September 2019

In September 2019, U.S. overnight repo rates experienced a sudden and sharp spike, from around 2% to over 6% in a single day. Some trades even cleared at higher levels intraday.

The dislocation was driven by a temporary shortfall in cash. A combination of corporate tax payments and large Treasury settlement flows drained reserves from the banking system. At the same time, balance sheet constraints prevented large institutions from stepping in to lend.

The Federal Reserve responded by launching a series of repo operations to restore liquidity. These injections calmed the market quickly, but the episode highlighted how little excess capacity existed in the post-crisis funding system. It also prompted a broader rethink of how reserve levels interact with repo market functioning.

Global Financial Crisis (2008–2009)

During the 2008 financial crisis, stresses in the repo market emerged well before the collapse of major institutions. As concerns about credit risk escalated, repo counterparties began demanding higher haircuts, particularly for lower-quality collateral such as mortgage-backed securities, or refusing to roll repo lines altogether.

Institutions like Bear Stearns and Lehman Brothers, which relied heavily on short-term repo funding to finance large securities inventories, found themselves unable to secure liquidity. The pullback in repo availability contributed to their rapid deterioration.

This episode underscored the repo market’s role as a transmission channel for systemic risk, especially when counterparties become unwilling to accept anything but the highest quality collateral.

March 2020

At the onset of the COVID-19 crisis, the US Treasury market—typically the most liquid in the world—experienced significant stress as investors rushed to raise cash. As Treasury securities were sold en masse, repo markets also came under pressure.

Market participants faced difficulty sourcing funding for even the most liquid collateral. Dislocations appeared in both general collateral and specials markets, and some firms were forced to unwind positions due to tighter margin conditions.

In response, the Federal Reserve reintroduced large-scale repo operations alongside a broader suite of liquidity measures. These efforts helped stabilise short-term funding markets and restore confidence in Treasury market functioning.

Key Participants in Repo Markets

The repo market brings together a wide range of participants, each with distinct roles depending on their funding needs, investment objectives, and access to infrastructure. While banks and non-bank financial institutions dominate in terms of daily activity, central banks play an outsized role in shaping the structure and pricing of the market.

– Banks and broker-dealers are the primary liquidity providers in the repo market. Dealers use repos to fund inventories of government securities, manage balance sheet liquidity, and intermediate between cash providers and borrowers. These desks often sit within broader short-term interest rate trading (STIRT) teams or as part of financing units under fixed income, currencies, and commodities (FICC) divisions.

In tri-party and bilateral repo markets, dealers act as both counterparties and facilitators. On the borrowing side, they finance their own positions or source collateral for client trades. On the lending side, they provide access to repo for institutional cash investors, often matching flows across books to run “matched repo” operations that generate spread income.

– Hedge funds are also active repo borrowers. They use repos primarily to obtain leverage for directional or relative value strategies, particularly in government bond markets. For example, hedge funds executing basis or curve trades often rely on repo financing to take on large bond positions while minimising capital deployment.

Because repo transactions are collateralised, they typically offer hedge funds a cheaper form of leverage than unsecured borrowing or derivatives margin funding. This makes repo a central component in leveraged fixed-income strategies.

– Money market funds (MMFs) are among the largest repo lenders. These funds seek secure, short-term investments, and repos meet both their liquidity and credit quality requirements.

MMFs routinely provide cash to dealers in the tri-party market, receiving high-quality collateral in exchange. This function supports market liquidity and provides a key funding channel for primary dealers.

– Central banks participate in repo markets to implement monetary policy, not to meet funding needs. Through repo and reverse repo operations, central banks manage short-term interest rates and influence liquidity conditions.

Facilities like the Federal Reserve’s Overnight Reverse Repo Program (ON RRP) allow eligible counterparties—primarily MMFs, government-sponsored enterprises (GSEs), and banks—to invest surplus cash securely at the administered rate, which acts as a floor for overnight rates. Conversely, standing repo facilities (SRF) allow banks and dealers to obtain liquidity against government collateral, acting as a ceiling on funding costs.

These operations help central banks steer money market rates within their policy corridors and ensure orderly market functioning during periods of stress.

– Large corporates with substantial cash holdings may access repo markets indirectly, typically via banks or investment in money market funds. While they are not major drivers of daily activity, corporate treasurers occasionally use repo to enhance returns on idle cash while preserving overnight liquidity.

This type of participation is more opportunistic and is generally limited to the most creditworthy counterparties and highly standardised repo structures.

Speculation in Repo Markets

While the repo market is primarily transactional—serving the day-to-day funding and liquidity needs of banks, funds, and dealers—there are instances where it facilitates sophisticated trading strategies. These cases are relatively niche and often involve exploiting dislocations in funding rates or market structure.

Specials Trading

When a specific bond becomes scarce in the market, often due to heavy short interest or its status as a benchmark issue, it may trade at a “special” repo rate, meaning it clears well below the GC rate. This dynamic creates opportunities for repo desks and traders with access to that security.

Example: A trader anticipates that a newly auctioned Treasury note will become “special” due to elevated short demand or benchmark index inclusion. They acquire the bond in the cash market and simultaneously lend it out via a repo agreement. If demand rises and the repo rate on that specific bond falls, the trader benefits from the spread between GC funding and the now-lower special rate, effectively earning a premium for supplying the scarce collateral.

This approach does not involve directional risk on rates or prices. It is purely an attempt to monetise the collateral premium embedded in specials pricing.

Basis Trading

Repo markets also play a supporting role in basis trades, where traders arbitrage the price difference between a cash bond and its corresponding futures contract. This typically involves buying the underlying bond and selling the futures contract short.

To execute the bond leg, traders need to fund the purchase, often done through repo. The repo provides efficient, secured financing and reduces the cost of carry, which is a key component in determining the profitability of the trade.

The repo rate directly impacts the implied basis and can influence trade entry levels. While the strategy itself is not about the repo market per se, successful execution often depends on reliable access to repo funding at known rates.

Conclusion

Repo markets form the foundation of modern market liquidity. They enable institutions to finance positions, manage balance sheets, and transmit monetary policy efficiently. When functioning normally, the system remains largely invisible, facilitating trillions in daily flows with little disruption. But when cracks appear, the effects are felt quickly and broadly, exposing just how critical this market really is.

Whether through stress events, dislocations in collateral, or subtle shifts in repo rate dynamics, the repo market offers a real-time lens into the financial system’s liquidity conditions. For those involved in trading, risk management, or macroeconomic strategy, understanding repo is not optional—it’s foundational.

-